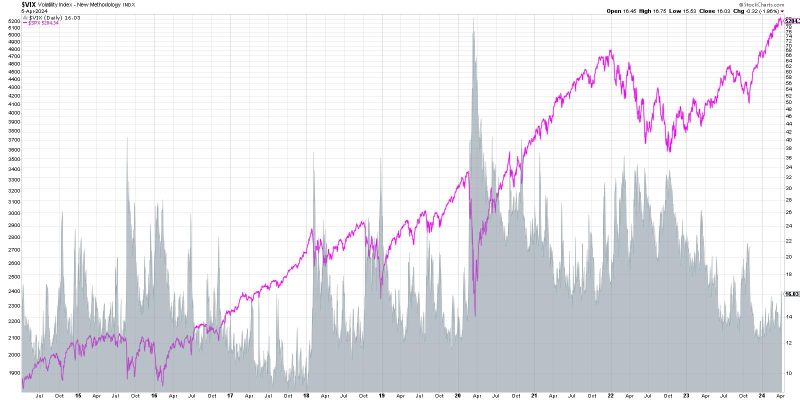

VIX Spikes Above 16 – Is This the End?

The recent spike in the VIX, also known as the CBOE Volatility Index, has caused a lot of speculation and concern in the financial markets. The VIX is a key measure of market volatility and is often referred to as the fear gauge as it tends to increase when investors become more nervous about potential market downturns.

The VIX recently surged above the 16 level, prompting many market participants to wonder if this spike is signaling the end of the current bullish run in the stock market. While it’s true that a higher VIX level can indicate increased market uncertainty and potentially higher levels of volatility, it’s important not to jump to conclusions based solely on this metric.

One important factor to consider when interpreting VIX spikes is the context in which they occur. For example, a sudden spike in the VIX following a period of prolonged market calm may indeed be a cause for concern as it could be signaling a shift in investor sentiment. On the other hand, spikes in the VIX during times of heightened market activity, such as around earnings season or during geopolitical tensions, may not be as significant in terms of predicting market direction.

It’s also worth noting that the VIX is just one of many tools that investors can use to gauge market sentiment and assess risk. While a spike in the VIX may indicate short-term turbulence ahead, it’s not a definitive signal of an impending market crash. Investors should consider a range of factors, including economic data, company earnings, and geopolitical events, when making investment decisions.

In conclusion, while the recent spike in the VIX may have rattled some investors, it’s important to keep a level head and not overreact to short-term fluctuations in market volatility. The VIX can be a useful tool for understanding market sentiment, but it’s just one piece of the puzzle when it comes to navigating the complexities of the financial markets. By staying informed, diversifying your investments, and maintaining a long-term perspective, investors can weather market storms and potentially even find opportunities amidst the volatility.