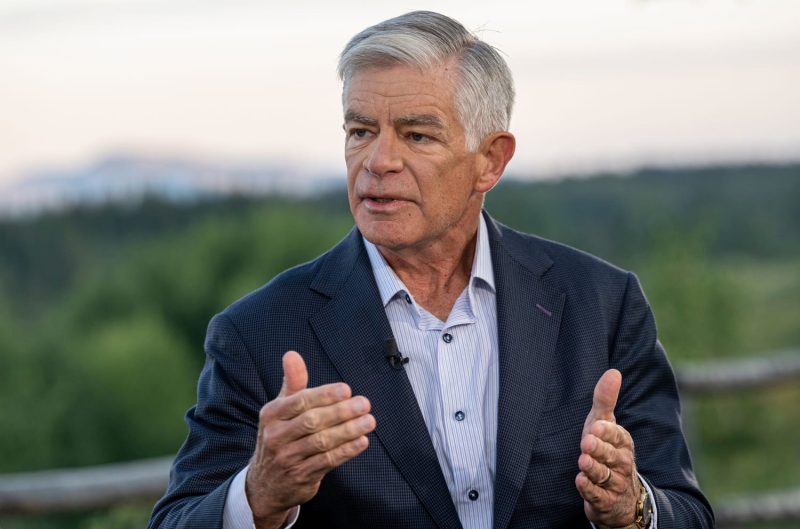

The Philadelphia Federal Reserve Bank’s President, Patrick Harker, Advocates for Interest Rate Cut in September

In a recent press release, Philadelphia Federal Reserve President Patrick Harker made headlines by advocating for an interest rate cut in September. This move has sparked discussions and debates within the financial world as experts analyze the potential implications and outcomes of such a decision.

Harker’s advocacy for an interest rate cut stems from his concerns over the global economic slowdown and the potential impact of trade tensions on the U.S. economy. He believes that lowering interest rates could help stimulate economic growth, mitigate risks, and provide necessary support to the economy amid challenging times.

The decision to cut interest rates is not without its risks and considerations. While a rate cut could boost economic activity, it may also lead to concerns about inflation and asset bubbles. Additionally, lowering interest rates could impact savers and retirees who rely on interest income, potentially reducing their spending power.

Harker’s stance has added to the ongoing debate within the Federal Reserve regarding the appropriate monetary policy to foster economic stability and growth. The Fed faces the delicate task of balancing the dual objectives of maintaining low unemployment and stable prices while navigating uncertainties in the global economy.

If the Federal Reserve decides to follow Harker’s recommendation and implement an interest rate cut in September, it could have far-reaching implications for financial markets, businesses, and consumers. Investors are closely watching for any signals from the Fed regarding its monetary policy decisions and are preparing for potential changes in interest rates.

The outcome of the Federal Reserve’s meeting in September will likely have a significant impact on the trajectory of the U.S. economy and global financial markets. As policymakers weigh the potential benefits and risks of an interest rate cut, they must carefully consider the implications for long-term economic stability and sustainable growth.

In conclusion, Patrick Harker’s advocacy for an interest rate cut in September reflects the challenging economic environment and uncertainties facing policymakers. The decision of the Federal Reserve regarding monetary policy will be closely monitored by all stakeholders as they assess the potential impact on the economy and financial markets. By navigating these complexities with prudence and foresight, the Federal Reserve aims to sustain economic growth and stability in the face of evolving global dynamics.