As investors navigate through the ever-changing landscape of the stock market, staying informed about potential profit-taking bouts and stock-specific movements is crucial for making wise investment decisions. This article will provide insights into the week ahead, emphasizing the importance of guarding profits and maintaining a watchful eye on stock-specific developments.

Guarding Profits Amidst Market Volatility

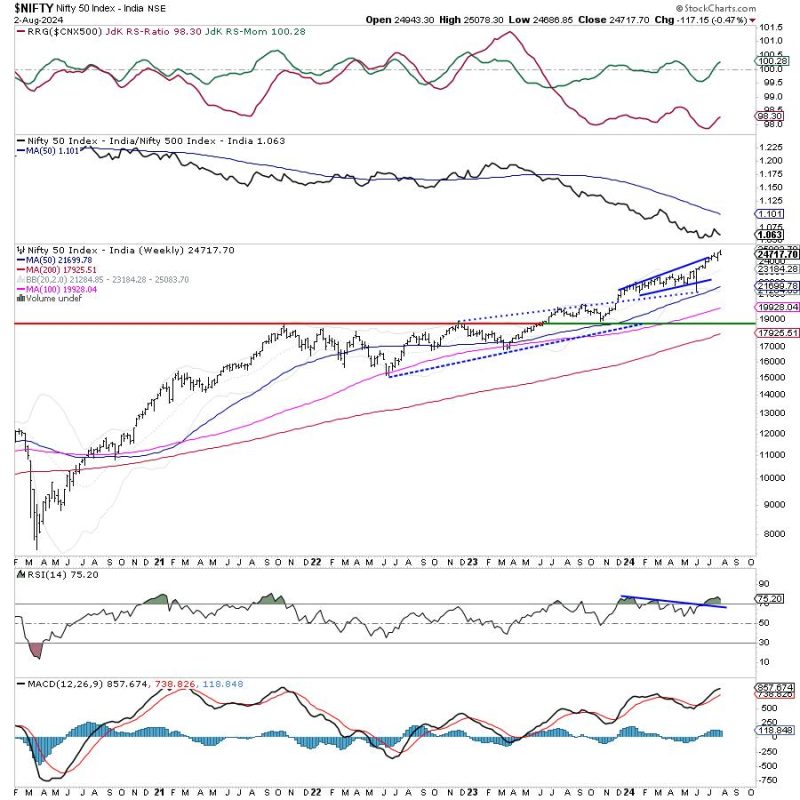

In a volatile market environment, guarding profits becomes essential to protect gains and minimize losses. As the Nifty index remains prone to profit-taking bouts, investors should exercise caution and consider implementing risk management strategies. Setting stop-loss orders, defining entry and exit points, and regularly reviewing portfolio performance are effective ways to guard profits in the face of market uncertainty.

Staying Stock-Specific for Sustainable Returns

While market trends can impact overall portfolio performance, focusing on specific stocks with strong fundamentals and growth potential can lead to sustainable returns. Conducting thorough research, analyzing financial statements, monitoring industry trends, and keeping abreast of company news are key components of stock-specific investing. By identifying undervalued stocks or those with upcoming catalysts, investors can enhance their chances of outperforming the market.

Key Developments to Watch Out For

In the coming week, investors should pay attention to market indicators, economic data releases, corporate earnings reports, and global events that could influence stock prices. Factors such as interest rate decisions, inflation figures, geopolitical tensions, and developments in the technology sector can have a significant impact on market sentiment and investor behavior. Staying informed about these key developments can help investors make informed decisions and adapt their investment strategies accordingly.

Diversification as a Risk Management Tool

Diversification is a fundamental risk management tool that can help investors reduce the impact of market volatility on their portfolios. By spreading investments across different asset classes, industries, and geographies, investors can minimize risk exposure and enhance the overall risk-return profile of their portfolios. Maintaining a well-diversified portfolio can provide stability during turbulent market conditions and mitigate the potential losses from any individual investment.

In summary, the week ahead presents opportunities for investors to guard profits, stay stock-specific, and make strategic investment decisions. By remaining vigilant, conducting thorough research, and diversifying their portfolios, investors can navigate through market uncertainties and position themselves for long-term success in the stock market.