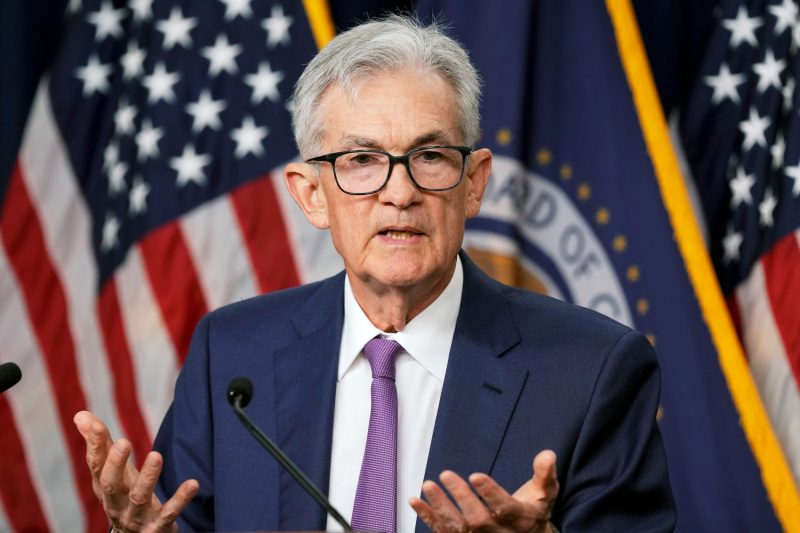

The recent statement by Federal Reserve Chair Jerome Powell reflecting on the unexpected high inflation rates has triggered uncertainty and speculation across various sectors of the economy. Powell’s acknowledgment of the inflation situation brings attention to the intricacies of economic forecasting and the challenges it poses for policymakers.

Inflation, as measured by the Consumer Price Index (CPI), has been soaring above expectations, surpassing the predicted rates and catching many by surprise. This deviation from the projections can have far-reaching implications on the Federal Reserve’s monetary policy decisions and the overall economic landscape.

The Federal Reserve plays a pivotal role in managing inflation through its control over interest rates and monetary policies. Powell’s remarks hint at a cautious approach, suggesting that interest rates are likely to remain steady in response to the prevailing high inflation. This decision reflects the Fed’s commitment to balancing economic growth with price stability.

The unexpected surge in inflation can be attributed to a multitude of factors, including supply chain disruptions, rising energy prices, and increased consumer demand post-pandemic. These variables have created a complex economic environment that challenges traditional forecasting models and necessitates a recalibration of policy responses.

The implications of higher-than-expected inflation extend beyond monetary policy decisions. Businesses may face challenges in adjusting product prices to align with increased costs, while consumers may experience reduced purchasing power as the cost of goods and services rise. This inflationary pressure can potentially impact investment decisions, job creation, and overall economic growth.

Powell’s acknowledgment of the inflationary trends underscores the importance of flexibility and adaptability in responding to economic uncertainties. As the Federal Reserve continues to monitor the situation closely, policymakers must remain vigilant and proactive in assessing the evolving economic landscape and implementing appropriate measures to mitigate the impact of inflation.

In conclusion, the revelation of higher-than-expected inflation rates by Federal Reserve Chair Jerome Powell highlights the intricacies and challenges of economic forecasting in a dynamic environment. The Fed’s commitment to maintaining interest rates steady reflects a cautious approach aimed at navigating the complexities of the current economic landscape. As uncertainties persist, stakeholders across various sectors must remain resilient and proactive in adapting to the changing inflation dynamics to ensure sustainable economic growth and stability.