The investment landscape is constantly evolving, with various factors influencing stock market performance. One critical element that has emerged in recent times is the shift towards value stocks, potentially signaling a downside risk for certain companies. Understanding this trend and its implications is crucial for investors seeking to navigate the market effectively.

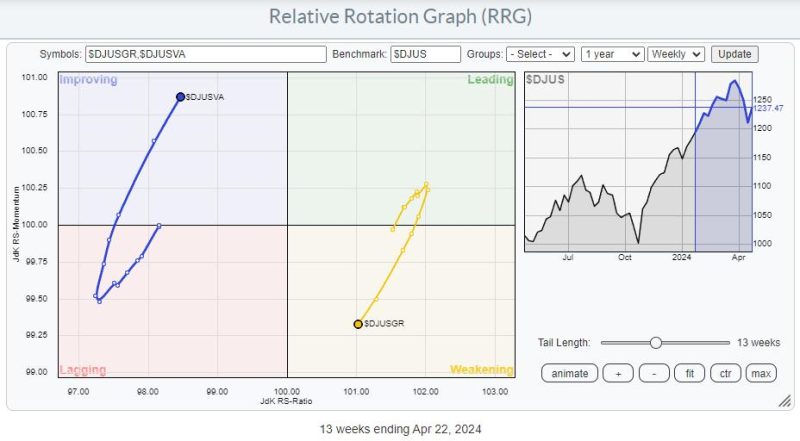

1. **Value Stocks on the Rise**: Value stocks, which represent companies trading at a lower price relative to their fundamentals, have gained traction in the current market environment. This shift is a departure from the growth stocks that dominated the scene in recent years, indicating changing investor sentiment and market dynamics.

2. **Cyclical Nature of Markets**: The market operates in cycles, with periods of growth followed by contractions. The resurgence of value stocks suggests a potential shift towards a more defensive investment approach, as investors seek out undervalued opportunities amidst economic uncertainties.

3. **Inflation Concerns**: Rising inflation is a key driver behind the move towards value stocks, as these companies are often better positioned to weather inflationary pressures compared to their growth counterparts. Investors are turning to stocks with solid fundamentals and stable cash flows to mitigate the impact of inflation on their portfolios.

4. **Interest Rate Dynamics**: Another factor contributing to the rise of value stocks is the specter of increasing interest rates. As central banks signal a shift towards tightening monetary policy, investors are reevaluating their portfolios and shifting towards assets that are less sensitive to interest rate movements.

5. **Tech Sector Headwinds**: The technology sector, which has been a major driver of growth in recent years, is facing headwinds as regulatory scrutiny and changing consumer preferences pose challenges for certain tech companies. This has led investors to reassess their exposure to growth stocks and consider value-oriented alternatives.

6. **Earnings Growth Expectations**: Earnings growth expectations play a crucial role in driving stock prices. Value stocks, with their emphasis on solid fundamentals and attractive valuations, may be better positioned to deliver consistent earnings growth in a potentially volatile market environment.

7. **Portfolio Diversification**: Diversification is a key principle in investment strategy, and the shift towards value stocks offers investors an opportunity to diversify their portfolios and reduce risk. By balancing their exposure to growth and value stocks, investors can potentially enhance their risk-adjusted returns.

8. **Long-Term Investment Strategy**: While market fluctuations and trends may impact short-term performance, a long-term investment strategy remains paramount. Investors should focus on their investment goals, risk tolerance, and time horizon when considering the role of value stocks in their portfolios.

9. **Risk Management**: Assessing and managing risks is essential in navigating the complexities of the stock market. By understanding the potential downside risks associated with value stocks, investors can implement risk mitigation strategies to protect their portfolios and optimize returns.

10. **Adaptability and Agility**: The investment landscape is dynamic and constantly evolving. Being adaptable and agile in response to changing market conditions is key to successful investing. By staying informed, seeking professional guidance, and maintaining a disciplined approach, investors can position themselves to capitalize on opportunities and mitigate risks in a value-driven market environment.

In conclusion, the resurgence of value stocks and the potential downside risks for growth stocks underscore the importance of vigilance, diversification, and strategic decision-making in investment management. By understanding the factors driving market trends and proactively adjusting their portfolios, investors can navigate the market with confidence and resilience.