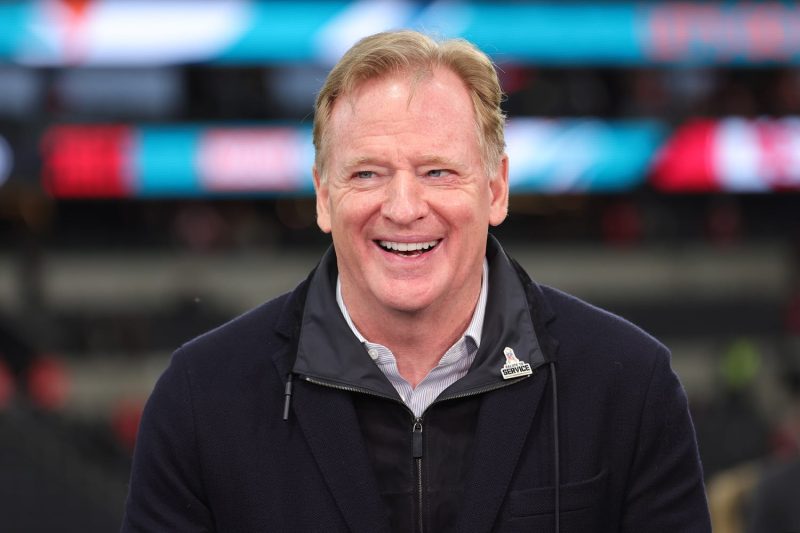

The NFL’s potential shift towards private equity team ownership, allowing investment firms to own up to 10% of franchises, has garnered significant attention within the sports industry. Commissioner Roger Goodell’s statement on this matter signals a potential new era in the ownership landscape of one of the most popular sports leagues in the world.

This move towards private equity investment in NFL teams signifies a strategic shift in how the league approaches ownership and financial sustainability. While the traditional model of ownership has long been dominated by wealthy individuals and families, the infusion of private equity firms brings a new dimension to the table. These firms, known for their financial acumen and focus on maximizing returns, may provide NFL teams with access to additional capital and expertise in managing resources.

However, this shift is not without its challenges and potential drawbacks. One concern raised by critics is the possibility of short-term profit motives driving decision-making within the teams. Private equity firms are known for their focus on maximizing returns in a relatively short period, which could conflict with the long-term strategic planning and sustainability goals of NFL franchises. Additionally, there is the question of how the involvement of private equity firms may impact the traditional fan-owner dynamic that has been a hallmark of the league.

From a financial perspective, the injection of private equity capital could provide struggling teams with much-needed resources to invest in player development, stadium infrastructure, and other areas crucial for long-term success. Furthermore, the involvement of investment firms with experience in managing complex financial transactions could potentially open up new revenue streams and business opportunities for NFL teams.

On the other hand, the potential influence of private equity ownership on the league’s governance structure and decision-making processes raises concerns about conflicts of interest and transparency. Given the significant financial stakes involved, it is essential for the NFL to establish clear guidelines and safeguards to ensure that the integrity of the league and its competitive balance are not compromised by the entry of private equity investors.

In conclusion, the NFL’s exploration of private equity team ownership represents a significant development in the business of sports. While this shift has the potential to bring new resources and expertise to NFL franchises, it also poses challenges related to governance, sustainability, and the fan-owner relationship. As the league navigates this new terrain, it will be essential to strike a balance between financial innovation and upholding the core values that have made the NFL a global sports powerhouse.