In a recent article by godzillanewz.com, the focus was on examining the warnings signals that financial indicators may be sending. The analysis revealed several key points that suggest potential challenges for investors and the broader economy.

The article started by highlighting the importance of keeping an eye on financial metrics to gauge the health of the economy. It pointed out that while stock markets have been performing well, other indicators such as the yield curve inversion and rising inflation rates could signal trouble ahead.

One of the key warning signals discussed in the article was the flattening yield curve, particularly the narrowing spread between short-term and long-term interest rates. Historically, an inverted yield curve, where short-term rates are higher than long-term rates, has often preceded economic recessions. This could point to a potential slowdown in economic growth in the near future.

Another critical point raised in the article was the increasing inflation rates. As inflation rises, it erodes the purchasing power of consumers and puts pressure on central banks to raise interest rates to curb inflation. This could potentially lead to higher borrowing costs for businesses and individuals, impacting spending and investment decisions.

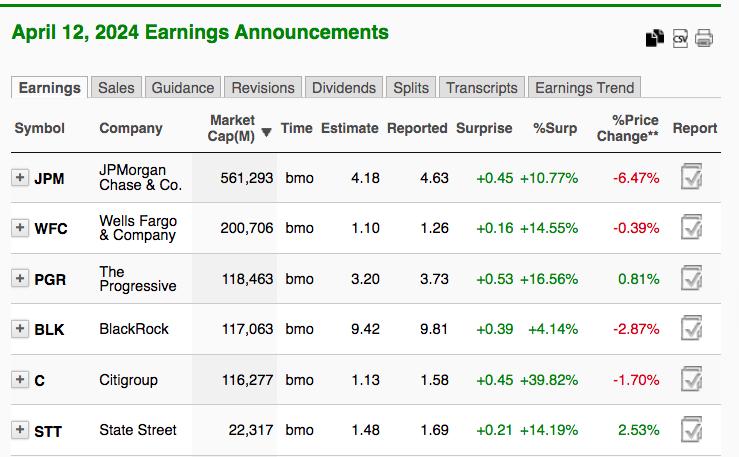

Moreover, the article highlighted the importance of monitoring corporate earnings and revenue growth. Despite strong stock market performances, if companies start to report weaker earnings or revenue growth, it could be a sign of underlying economic weakness. This could lead to downward pressure on stock prices and broader market indices.

The discussion also touched on the impact of global trade tensions and geopolitical uncertainties on financial markets. Any escalation in trade disputes or political instability could have ripple effects on economies and financial markets worldwide.

In conclusion, the article emphasized the importance of paying attention to warning signals from financial indicators to make informed investment decisions. By staying abreast of economic data and market trends, investors can better navigate volatile market conditions and position themselves for potential challenges ahead.

Overall, the insights provided in the article shed light on the potential risks that investors and businesses may face in the current economic environment, urging vigilance and strategic planning in navigating the uncertain financial landscape.