In the realm of trading and investing, the ATR trailing stop has emerged as a powerful tool for managing trades and defining market trends. This innovative method takes advantage of the Average True Range (ATR) indicator to establish dynamic stop-loss levels. By adapting to market volatility, the ATR trailing stop helps traders protect their profits and navigate changing market conditions with confidence.

The ATR trailing stop operates by adjusting the stop-loss level based on the volatility of the asset being traded. Unlike traditional fixed stop-loss orders, which remain static regardless of market conditions, the ATR trailing stop recognizes that different assets exhibit varying degrees of price fluctuation. By incorporating the ATR indicator into the stop-loss calculation, traders can ensure that their positions are protected against excessive downturns while still allowing room for the asset to breathe and capture potential gains.

One key advantage of the ATR trailing stop is its ability to accommodate market fluctuations and prevent premature stop-outs. Traditional fixed stop-loss orders may trigger too soon in volatile market conditions, cutting short a potentially profitable trade. In contrast, the dynamic nature of the ATR trailing stop allows traders to ride out short-term ups and downs, giving their positions the flexibility needed to weather market turbulence.

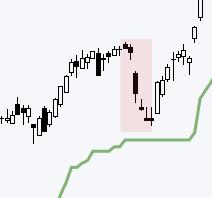

Moreover, the ATR trailing stop serves as a valuable tool for trend definition in trading. By adjusting the stop-loss level according to the ATR indicator, traders can follow the natural ebb and flow of the market while minimizing the impact of false breakouts or temporary price retracements. This approach helps traders stay aligned with the prevailing trend and avoid getting caught in whipsaw movements that can erode profits and lead to unnecessary losses.

In practical terms, traders can implement the ATR trailing stop by setting a stop-loss level a certain multiple of the ATR value away from the current price. As the market moves, the stop-loss level will adjust based on changes in volatility, ensuring that profits are protected while still allowing for potential upward momentum to be captured. By actively managing the trade using the ATR trailing stop, traders can maximize their chances of success in the dynamic world of trading and investing.

In conclusion, the ATR trailing stop represents a sophisticated and effective method for managing trades and defining trends in the financial markets. By harnessing the power of the ATR indicator to set dynamic stop-loss levels, traders can protect their positions against adverse market movements while remaining agile and responsive to changing conditions. With its ability to adapt to market volatility and capture profitable trends, the ATR trailing stop is a valuable tool for traders seeking to optimize their trading strategies and achieve consistent success in the competitive world of finance.